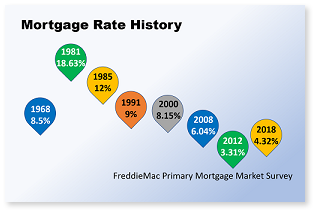

Mortgage interest rate history is interesting and rates have the biggest impact on housing affordability. In 1968 (when I was just a little kid) interest rates were 8.5%, but dropped to 7% a year later. In October 1981, they hit a high of 18.63%. A $250,000, 30 year fixed mortgage with that interest rate had a monthly principal and interest payment of $3,896.46. As crazy as that sounds, people were still buying homes and considered them good investments.

I’ve personally had experience with the fluctuation in interest rates: we missed the high in 1981, but the second home that Dan and I purchased during our relocation across the country was in Dallas in 1985. Our interest rate was 14.25% on an adjustable rate mortgage! Less than two years later, interest rates were still over 12%. Using the same example above, the monthly payment would be $2,571.53. We paid about that when we relocated to California in 1987; our mortgage payment was $2,575 for a house that we bought for $187,500. Believe it or not, we were excited to be paying only 2/3 of what we had to pay a few years earlier.

We never found anyone whose mortgage we could assume, but if we had we would have been excited about it too. VA and FHA mortgages were very popular in certain price ranges and allowed anyone to assume the mortgage regardless of their credit. The person assuming the mortgage was happy getting a 15-20% bigger house for the same payment, while the person selling was free to qualify for another mortgage.

We didn’t see interest rates change too much during the 90’s between when we bought our house in Ohio, and our first home in AZ. They were hovering between 8-9%, which doesn’t seem like a big change. On a mortgage payment though, it could range from $1,860-2,015 a month.

During the housing bubble, interest rates had dropped to only 6.04% (a steal if you knew what they were before!) and for that $250,000 house your payment was only $1,505.31. By 2009 interest rates had fallen below 5%, and if you were lucky enough to nail the bottom November 2012 with 3.31%, your payment would have been $1,096.27/month.

Rates have fluctuated slightly for the last few years now, but have increased each week for the last six weeks to 4.38%, which would be a payment of $1,240.12. Most of the experts are expecting them to be above 5% by the end of 2018. As one contemplates the interest rates and their history, a half point shift may seem huge today when in reality it’s pretty small. Young buyers probably have a different perspective though, most are payment-conscious and they’ve only been around long enough to see the $200/month increase.

Still, the average interest rate over the past 47 years is a little over 8%. Like real estate, the mortgage markets are cyclical. Rates have been historically low for a long period but will probably continue to rise. Based on the history, even 8% would be an excellent rate – until it reaches that point again, everything lower is a bargain. Having a mortgage and owning a home now is still better than trying to save $250,000 to pay cash while spending the same amount of money each month on rent (if not more!).

If you’ve been thinking about buying a home in the near future, contact me today at 480-355-8645 or by email at Info@LocateArizonaHomes. I’d love to put you in touch with one of our great lender partners and share some of the things we did to make buying a home at a higher interest rate a great option!